You cannot use the dependent care fsa to reimburse for health care expenses incurred by a dependent. What is the 2025 dependent care fsa contribution limit?

For health fsa plans with the optional health fsa. The internal revenue service (irs) limits the total amount of money that you can contribute to a dependent care fsa.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Your dependent children under the age of 13. What is the 2025 dependent care fsa contribution limit?

Dependent Care FSA University of Colorado, The dependent investment income limit for 2025 is $2,200. If you’re married, you and your spouse can each contribute up to $3,200.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, If you have young children, you already know that. If you’re married, you and your spouse can each contribute up to $3,200.

Dependent Care Flexible Spending Account (FSA) AwesomeFinTech Blog, You can contribute up to $5,000 in 2025 if you’re married and file jointly with your spouse, or if you’re a single caretaker for a dependent. Priscawelana.pages.dev acp limits for 2025 addie anstice , if your spouse died in 2025.

Dependent Limit 2025 Tara Zulema, You cannot use the dependent care fsa to reimburse for health care expenses incurred by a dependent. It explains how to figure and claim the credit.

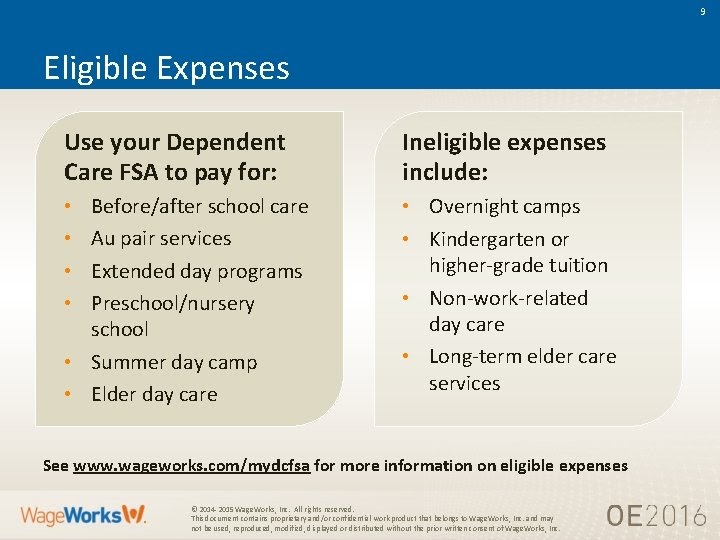

Wilhemina Howland, Your dependent children under the age of 13. The dcfsa covers eligible daycare expenses for your children under 13 or.

Fsa Approved List 2025 jaine ashleigh, The irs sets dependent care fsa contribution limits for each year. The dependent investment income limit for 2025 is $2,200.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, If one spouse is considered a highly. Unlike a healthcare fsa, dependent care accounts (dcas) offer a family contribution option, which means you only need one dca to cover your household.

Irs List Of Fsa Eligible Expenses 2025 Rorie Claresta, Internal revenue code §129 sets the annual dependent care fsa contribution limit at $5,000 (or $2,500 for married individuals filing separately). However funds in a flexible spending.

dependent care fsa limit Reactive Cyberzine Image Library, You may enroll in an fsa for. The maximum amount you can.